Deal opportunities in stormy weather

| Published |

|---|

The deal profiles that I see have changed dramatically in the last year, and I expect 2023–24 to continue bringing more sensible options for investment. Before diving into what’s on the radar, let’s take a look at the underlying factors for the change.

VC is sailing through rough waters

The VC industry ship is sailing in stormy waters. The high interest environment following 12 years of ultra low (and negative real) interest rates roughed up the seas for the innovation community. There are a number of dynamics at work:

- VCs are seeing their portfolios under significant pressure from the market correction, where paper multiples are being squashed by lurking down rounds

- LPs are more inclined to put capital at work in less riskier capital allocation strategies where rates are 2–3x of what they used to be

- LPs are subject to interest rate pressure as well, with less capital available to honour the capital calls for committed funds

But wait, the above dynamics impact mostly new fundraising, and you might have seen media tout that the VC industry has loads of dry powder!

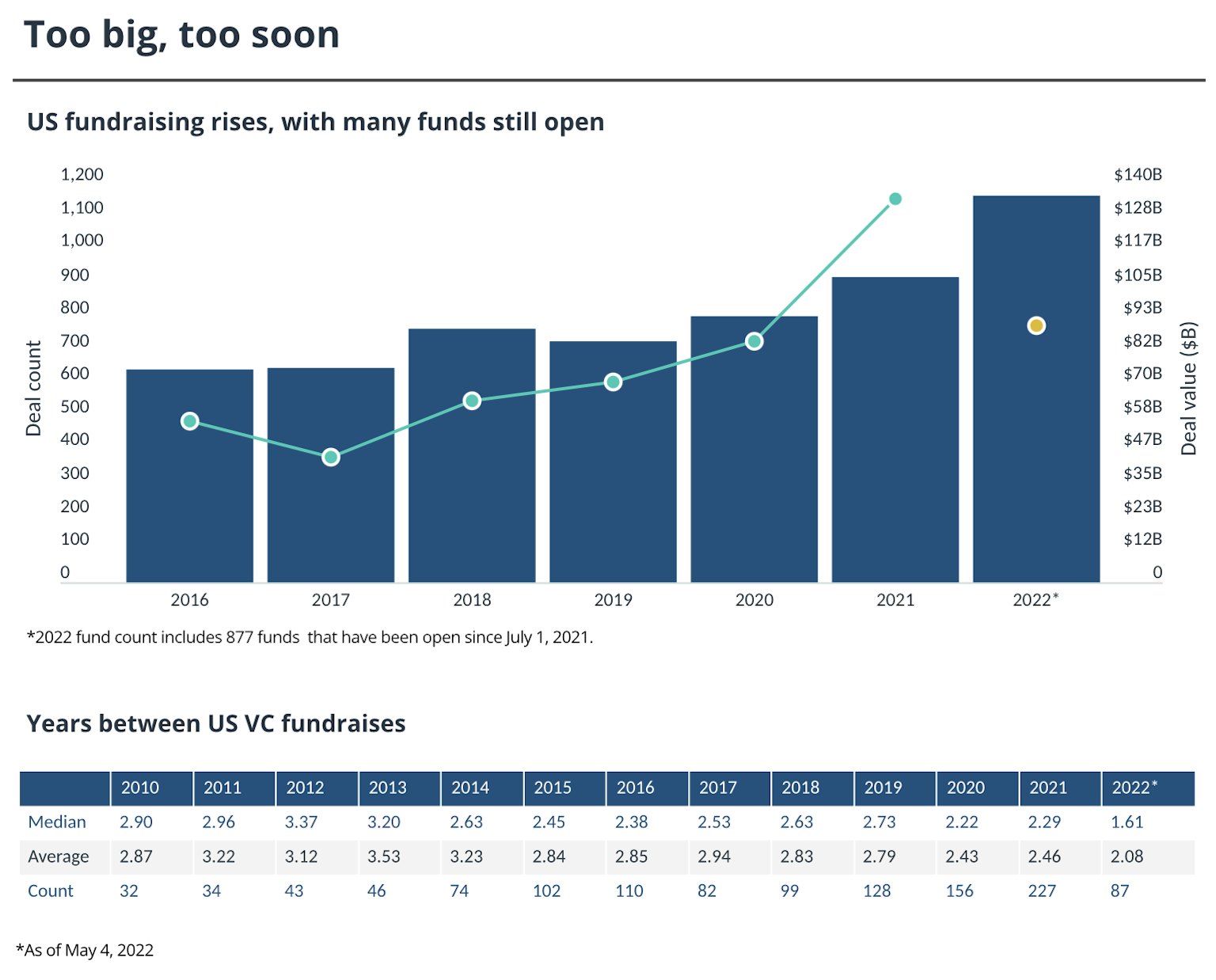

In 2022, VCs raised a grand total of $162.6 billion across 769 funds in fresh capital. That followed 2021’s own venture fundraising record of $154.1 billion. As of Sep 30, 2022, there was about $298.5 billion of dry powder. — PitchBook.

This dry powder, however, might be damper than we think. There are a number of key reasons that underpin this sentiment:

- Reconsideration of LP commits. Yes, LPs might have committed to fund managers ample capital during good times. The nature of the industry is that committed capital is not in VC’s bank account until called. When market conditions change, LPs are faced with a problem: “Do I honour the commitment to the GP, or do I take a risk-sensible strategy?” Some of the pension funds might also not have a choice — rising bond yields force institutions to reallocate capital (or altogether sell securities) in order to satisfy liquidity requirements. In this scenario the GP gets a call from the LP, and the message is: “I know I have committed 50m to your fund, but I can only do 25”. Do you think the GP will follow a legal path and force the commitment? That would be their last act as a fund manager.

- Focus on existing portfolio survival. Founders are having a pretty tough time as well — raising new capital is a problem. So they go back to their existing investors and ask for survival capital. VCs with a number of funds under their belt (which is where the majority of the damp powder is) and no clear visibility of additional commits have to prioritise their allocations. There is a refocus on portfolio survival rather than new investments. Most VCs cannot support all companies in their portfolio, so they choose some and let the rest go. In short, there is less VC money for new deals.

The VC industry is undergoing a cleansing after years of froth, much like the startup ecosystem. Many funds became ghosts (active in name but not making new investments). Many failed to raise and will be winding down. All tightened their belts, and much like the startups, focused on performance, which means more resources for portfolio companies rather than new bets.

Deal profiles

I see 5–10 news deals per day (over 1000 per year) primarily from UK, the continent, and USA. Below is an account of some flavours (in no particular order).

The Delusionals

Long gone are the days where a founder with top school/tech company pedigree is seeking $5m in pre-seed or seed capital at a $25m pre-money valuation based on a load of promises and little to no traction. Once in a while I still see some (mainly from the USA), and I am baffled by how they still have not gotten the memo.

A key oversight of such founders is that they are setting themselves up for huge disappointments in the next (down) rounds. A key oversight of the (angel) investors in such ventures is that they are bound to get diluted to nothing in the coming (down) rounds. And that is in the best case scenario. More on this in The Unfortunates section.

The Unfortunates

These are startups that have been screwed over as a result of their prior fundraise. If a company raised a round at 50–100x ARR (as it was common enough in the hey days of 2020/21), they’d be coming to market about now to raise again. The startup might have a great product, a highly skilled team, be in a huge and growing market and all that jazz. But the times shifted from growth and promises to profitability, and respectively to a 5–20x early stage ARR multiple environment. So if the startup had 100k in ARR and raised at a 5–10m pre-money (6–12m post-money), then to justify the same valuation 18–24 months later they would have had to grow revenues by 3–24x. A 3–6x growth over two years is expected of a high profile company, a 24x growth is an anomaly.

So what do they do? Unfortunately founders and prior investors have to accept the reality of a down round. Many still have not gotten this memo either.

The Grinders

Many deals in the scene are sensible and grounded in reality — great products and great teams, however exhibiting a slowed down traction in a market where the product is not mandatory or where there are strong incumbents (and therefore increased competitive pressure). A number of these deals will weather the storm and grow into becoming great successes if they manage to attract funds to see it through to clear skies.

A number of my portfolio companies are in this category, but, in comparison to many, they do have best-in-class products, which makes them the strong incumbents and potential category winners. Both companies have full coffers from top VCs, excellent management, and a growing traction (though traction comes with hard work).

The Disrupters

There are also the early stage disrupters aiming to shake up a given space through a technological deep tech breakthrough. These deals tend to be early in commercial traction but bear high potential. They will require longer to get there, and once and if they do, the rewards are worthwhile.

Disrupters have been and remain my main investment thesis focus.

An upcoming 2050 Capital investment in quantum sensing technology (that I have been watching for 18 months), is in this group. Biotech breakthroughs have their place in here as well.

At the moment though I seek Disrupters with two additional flavours:

- The Inevitables — best-in-class product in a non-discretionary spend market

- The Chosen Horses — VC portfolio winners seeking gap funding

The Inevitables

The first type is impervious to market conditions. It is a category driver, riding a growing market pull. As the market grows, so does the venture providing it retains technological superiority and exhibits a solid execution. Our recent investment in quantum communication security is a good example. The problem the venture solves is inevitable, the market is growing, and the tech is best-in-class. They can still screw up on execution, but with team’s focus and humility and a roster of sensible funds on the cap table to guide them along the way, the risk is mitigated.

The Chosen Horses

The second type is inherent to the current market. As mentioned in part 1 of this write-up, due to limited capital in the market VCs are forced to choose the companies from their portfolio they will continue to support. They will choose the ones most likely to lead to success. These are their chosen horses. Not all will win, but the likelihood of success is higher.

Typically these deals are financed through internal bridge rounds, with no or little outside capital. Typically the terms are sensible because no existing investor will shoot themselves in the foot by hiking up the valuation unnecessarily. Investors require the company to survive and get to the other side on the basis of good execution, and they will do whatever it takes to help the startup get there.

The earlier mentioned quantum communication security also happens to be a Chosen Horse with a Disruptor / Inevitable flavour. Access to the deal was facilitated through a personal relationship. The increase in allocation was due to a thoughtful engagement with the founder and investors.

Closing thoughts

Although the VC industry ship is sailing in stormy waters, I see opportunity for nimble, value-add disciplined investors. I welcome the winds as it presents deals where the upside of a Disruptor is de-risked when it is simultaneously an Inevitable and a Chosen Horse.

Some Disrupters are Inevitables by the nature of the market they are in. Some Disrupters become a Chosen Horse by the nature of their evolution. Sometimes a startup is all of the above — a Chosen Inevitable Disrupter. These are the ones I seek.

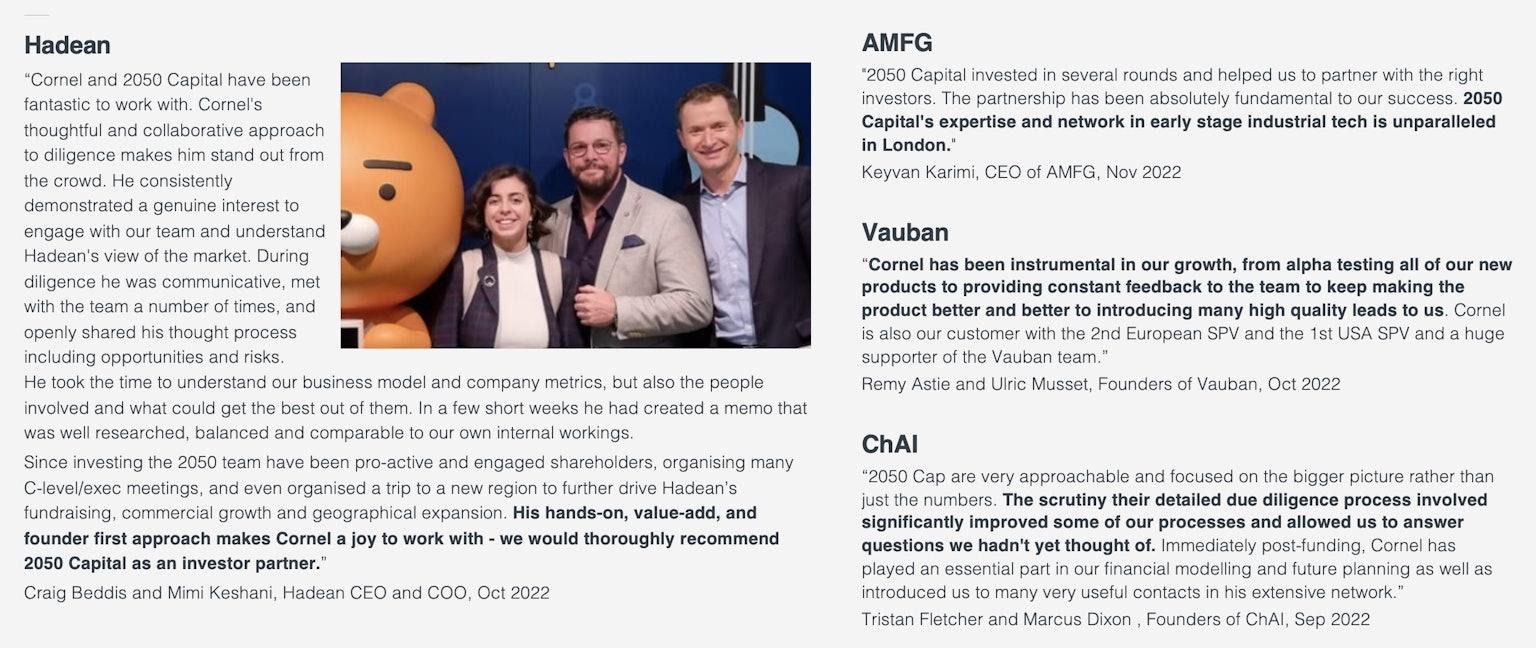

Access to such deals is difficult, even in hard times. The best way to win access is to add value, even before the investment is made. Period. And this is exactly what we do. From the 1st check onward we assist our portfolio companies with business development, strategy, and next stage fundraising. Once we become investors, we become partners.

In entrepreneur’s own words:

Onward! Cornel

Special thanks to my business partner — Alex Lintott, for his feedback on the write-up.