A note on founder discipline and character

| Published |

|---|

I wrote the below email to the AMFG shareholders after closing the Series A round.

Dear AMFG shareholders -

This is a slightly different email - forgive me the length, but I have a point to make.

Yesterday I met with Keyvan (the CEO) at his office.

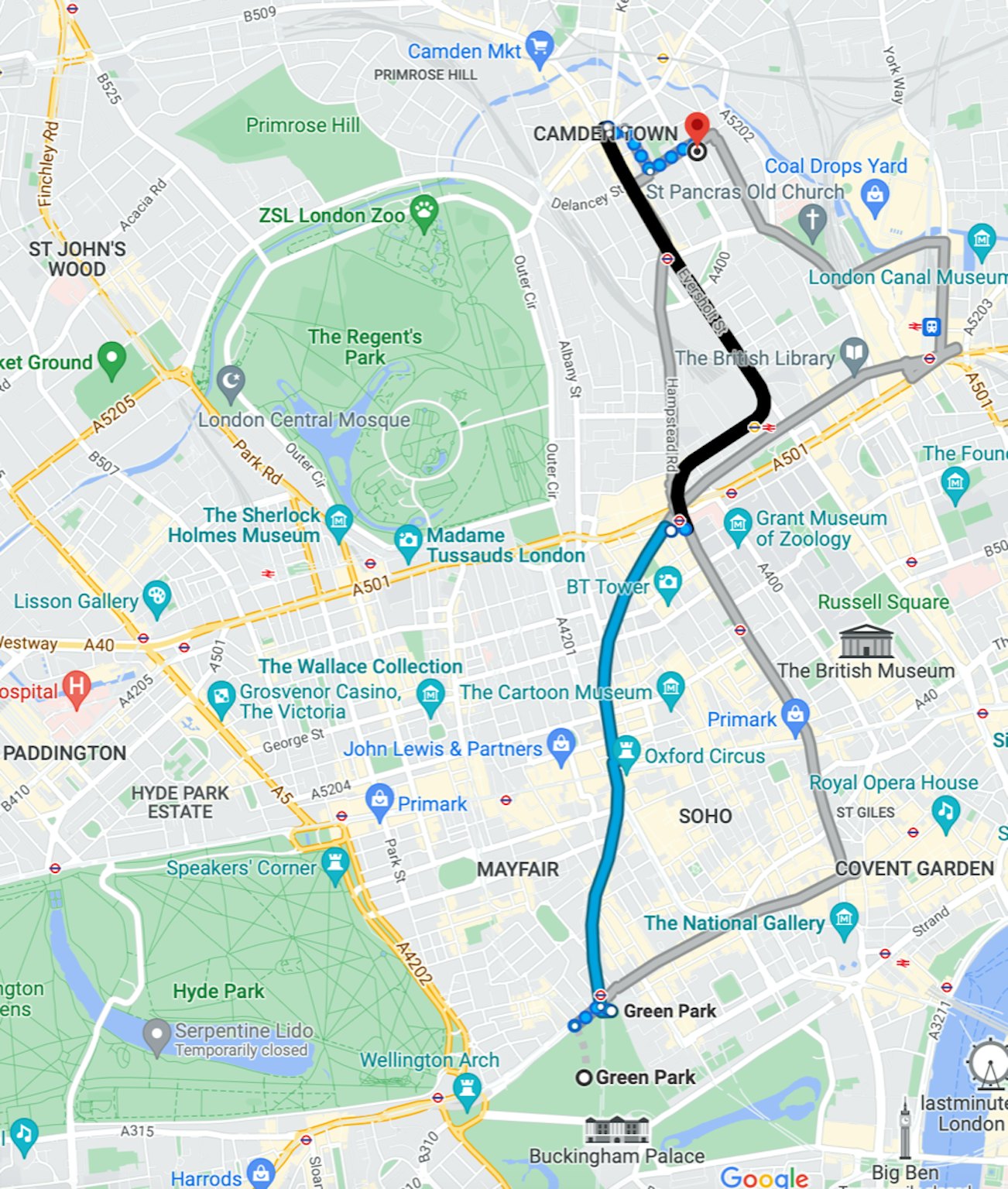

AMFG takes up the ground floor space on a quiet street, 7 min walk from Camden Town tube station. It’s not the posh part of town - it’s north of King’s Cross, in a neighbourhood peppered with mixed cuisines and mixed-style buildings, some of which might have been warehouses in their past life. It’s far from the prestige of Mayfair and even the new-found start-up fame of Old Street.

The office is managed by Workspace - an organisation with a network of shared office spaces. They tend to be gritty and budget oriented, with all the basics in place and no extra bells and whistles. Made for purpose, made for performance.

AMFG just moved in and I could still see boxes that required unpacking. The team was hustling on calls with customers or glued to the screens in focused execution. Two-thirds of the people were on customer sights working on projects. I met many of them for the first time since the pandemic hit. It was brief, polite, and then back to work.

Keyvan and I got together to discuss the final touches of the round and the next steps. Intel transferred the funds. I am in the process of doing so as well. The deal is almost closed. The company is now focused on delivering on its ambitious goals. This year has been dedicated to fundraising and hiring the team to fuel growth. It will take 6 months to get them all up to speed, so think of 2022 as setting up the stage for 2023. There are a few major developments ahead - product releases relating to network efficiencies, a move into the CNC market space, and the growth in the USA market. That’s certainly exciting and Keyvan and team will update you in greater detail in due course. But this email is not about that.

This has been the largest round AMFG has done. It took nearly a year. It was certainly a cause for celebration. We found a small Greek place near the office, sat down, talked for an hour or so, and had tea. Just tea. The bill was probably less than £5. Keyvan paid.

After the excess of the past years when founders wasted money on unnecessary image-driven rubbish and growth at all costs we have come to a reckoning. The investing world seems to have woken up to “tighten your belt” and “mind the basics” letters from the likes of Y Combinator and Sequoia. Keyvan never had to wake up to it because he lived in this world all along, with a tight employee culture and a religious focus on the cause, and resources. This office, and this meeting, is a reflection of who he is and how he runs the business.

Built for purpose, built for performance.

I don’t know whether AMFG will deliver a 3x or a 20x return on the current round. But I can certainly promise you that Keyvan won’t waste a penny of your money in the pursuit of his, the team’s, and your goals.

Cornel