“Cherchez la Tech” or how to spot the Google of today

| Published |

|---|

Summary

“Software is eating the world”, famously stated Mark Andreessen of Andreessen Horowitz. I could not agree more. However, the world is big and there is a lot of software out there. If you are an aspiring technology investor with somewhat agnostic sector views, where do you start? Could have you spotted Google in 1999, Facebook in 2005, Uber in 2010, or DeepMind in 2011?

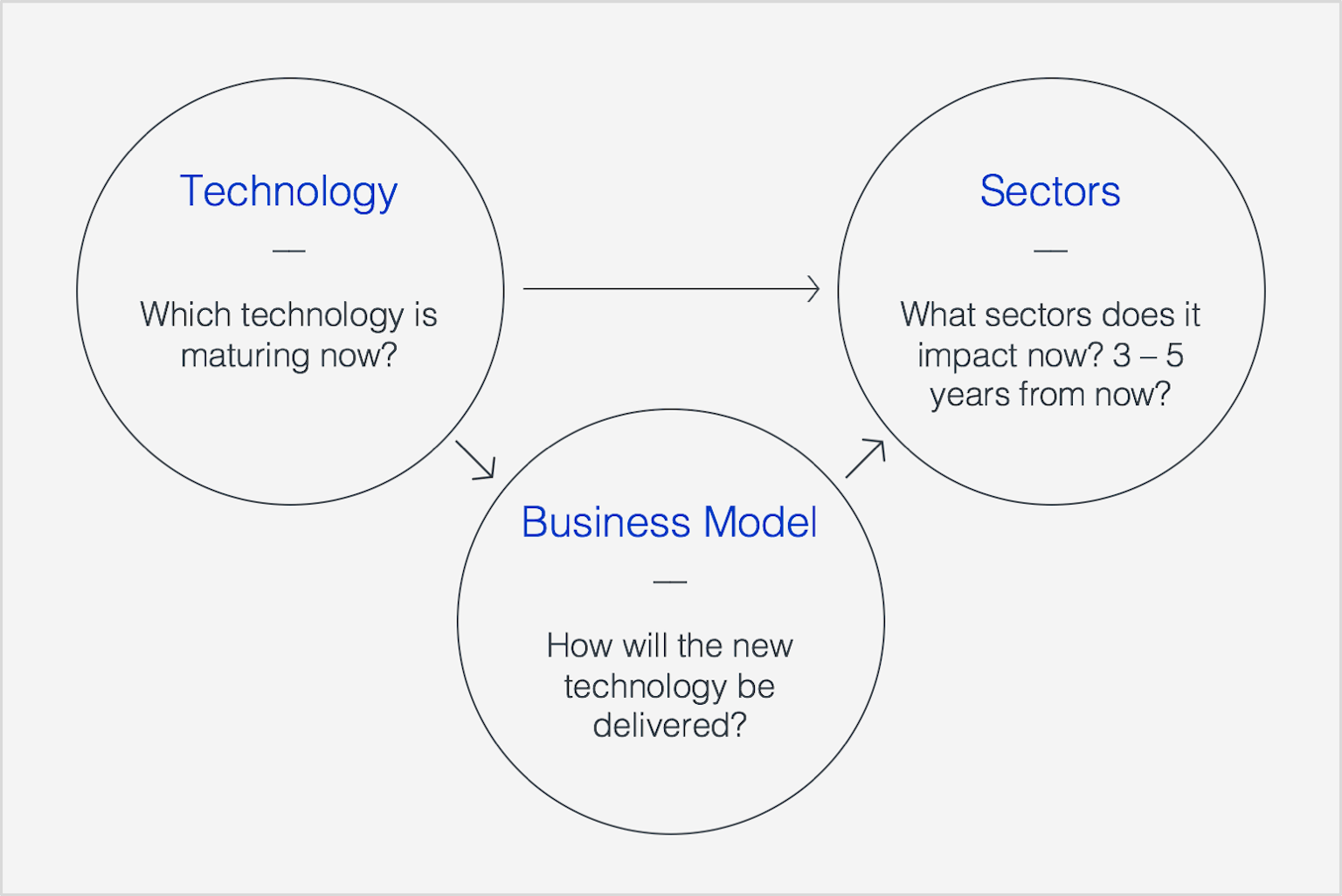

Consider a framework I half-jokingly call “Cherchez la Tech”, which has three key components:

- a maturing Technology,

- a “ready-for-disruption” Sector, and

- an “optimal delivery” Business Model

Disruption starts with the maturing of a certain technology for mass applications, which must be both effective and cheap enough to implement. Once the technology is identified, look for sectors and more importantly segments where the given technology has the potential to create new products and services or make existing ones be delivered faster, better, or cheaper. And finally, pick a business model that is optimal for delivering the technology in your chosen sector segment.

Read on for more details.

Technology: The Holy Grail

Technology serves as a powerful guide to choosing the sector segment and business model focus, both of which follow. As the first step in the process I ask myself “What technology is maturing now?” The timing is relevant because the technology that already matured likely achieved advanced commercial adoption. The space would be or begin to be crowded and a newcomer would be at a disadvantage.

Flashback to the late 90’s. The penetration of personal computers in the US surpassed 50% (Pegasus Research) and internet usage was on a brink of mass adoption, approaching fast the 50% adoption mark (Internet Live Stats). Matured internet access technology paved the way for the online superstore (i.e. Amazon) and the organiser of the world’s information (i.e. Google). It also allowed for the ‘garage sale’ to go global (i.e. EBay) powered by a trusted method to complete the transactions (i.e. PayPal). The visionaries of that era seized the opportunity of a maturing technology. And once they were under way, few joined their ranks at the top of the pyramid in the same space. The bulk of the cash flows of the future were largely already distributed.

Fast forward to mid 2000’s. The social network revolution is under way. It was borne out of a combination of socio-behavioural factors, such as the seclusion of the individual amidst a growing presence of technology, globalisation, and the individual’s craving for outreach and social companionship. It was made possible by technology. The same technological advancements that sparked the online commerce in the late 90’s moved on to allowing people to connect and share experiences. If one would have spotted the trend at that stage and allotted $100k equally amongst MySpace, Friendster, Facebook, and a few others, the outcome at this day would be in millions (about $50m) despite that Facebook is the only one standing tall from the bunch. There are of course numerous methodologies for increasing the chances of investing in the winning start-up, but that is well documented and this post’s focus is the “space” rather than the “target within the space.”

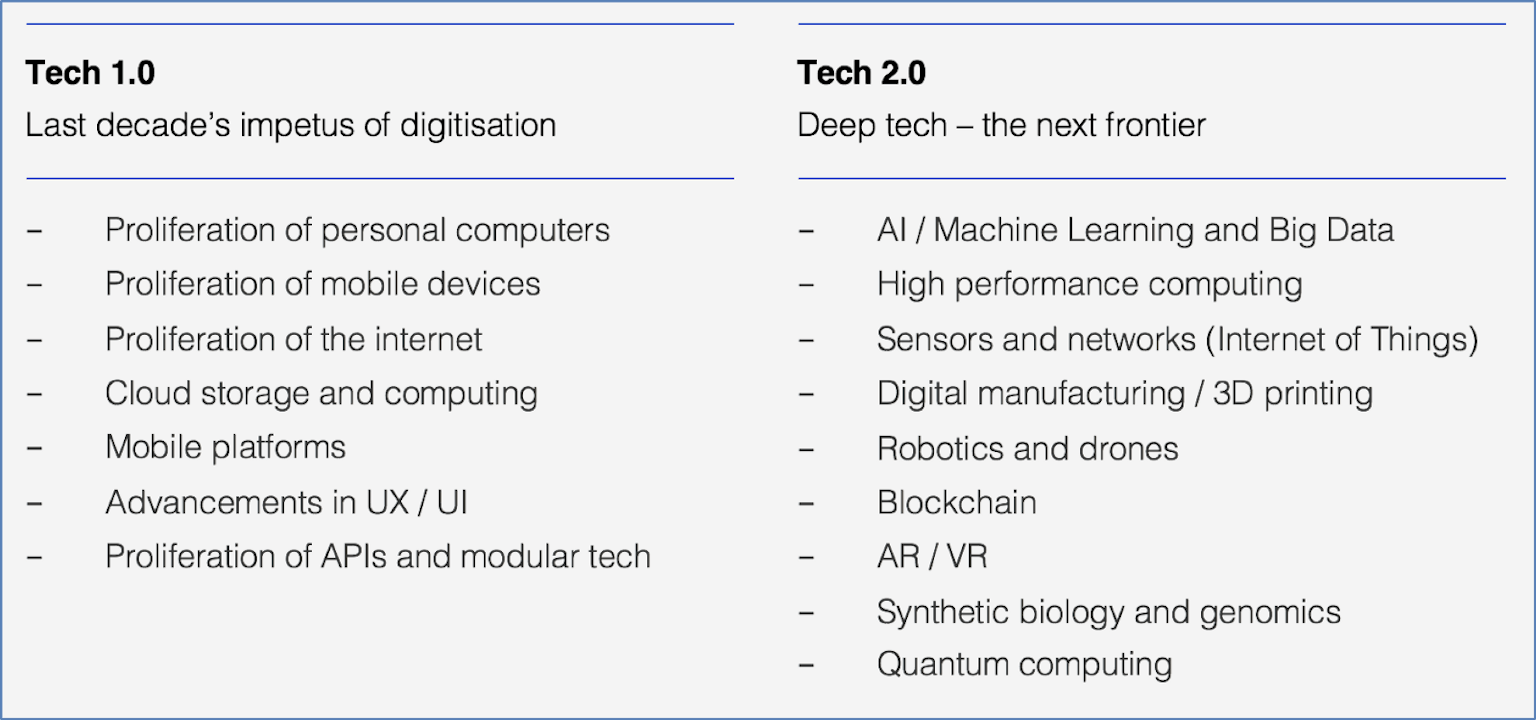

So, how does one know which technology is maturing? The below list (Tech 2.0) is a broad current indication of the technology that dominates the start-up ecosystem or is on the horizon to make its entrance. And there is so much more out there. Keep up-to-date by subscribing to technology blogs. Follow research that comes out of leading universities (e.g. MIT, Caltech, and my own alma mater U of Chicago). Read the work of thought leaders, such as Peter Diamandis’ Exponential Technologies. Follow experts in the field, such as Yann LeCun, Andrew Ng, Geoffrey Hinton and others for machine learning, for example.

To pick one example out of the bunch — machine learning — we are witnessing unprecedented advancements in this field. As machine learning algorithms become better than humans at specialised tasks, such as image recognition and language processing, we could see these advancements paint disruption for a number of high value sectors. This leads me to the next step — focus on a big sector that offers least resistance to commercially adopting the maturing technology.

Sector: The path of least resistance

“I want to invest in a start-up that uses machine learning. Now what?” This pursuit in itself made its way, foolishly, into a myriad of founder decks eager to tout that “We are an AI start-up disrupting the X sector.” Machine learning in itself is not the end, it’s means to an end. While machine learning is merely a tool to be used in the quest of building an intelligent business, it could serve as a starting point to filtering sectors that can undergo a revolution next. So, how should one do it?

When choosing the sector focus, ask yourself:

- In what sector and subsector will a particular maturing technology improve the current state by an order of magnitude?

- Is the sector (size of the opportunity) big enough?

- Is it ready for technology adoption?

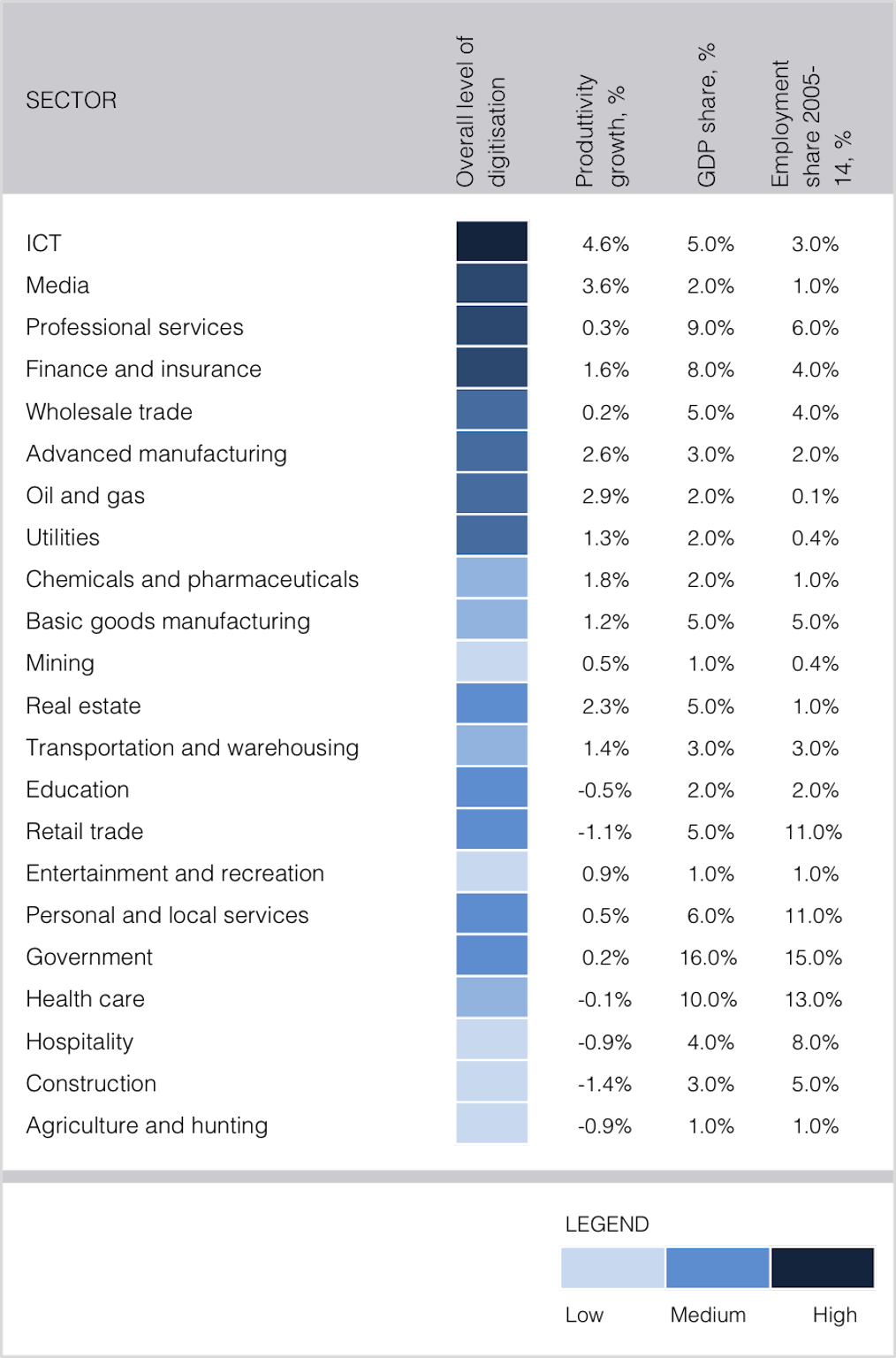

One viewpoint splits the field into digitised and underdigitised sectors. A 2015 McKinsey study notes that 65% of the US sectors by share of GDP are underdigitised. Digital leaders added 6 to 11% on average to their bottom line while laggers stayed flat or saw eroding profits (measured over 1993–2013). Both groups command a similar US GDP share — 30% and 35% respectively. The “size of the opportunity” is comparable hence the difference in the level of digitisation is due to the “readiness of adoption”. While leaders embraced technical innovation early on, laggers did not. However, the tides are changing and we see more and more capital flowing into the “boring” industries, flipping them upside down (as often pointed out by CB Insights). The opportunity to revolutionise traditional, underdigitised businesses is tremendous and the space makes sense as an overall asset allocation class. Leaps of orders of magnitude are easier when starting from a low base. We are likely to see new technology giants, empowered by ground-breaking technology, emerge in these sectors.

Source: McKinsey Global Institute, Dec 2015 (link)

Having said that, the game is typically played on a sub-sector level. There are ‘green field’ opportunities within highly digitised sectors as well, even though they might be harder to find. Successful start-ups could carve a place for themselves, soon to be swallowed by one of the incumbent technology giants (which is not a bad outcome). However, the strategy is unlikely to lead a start-up to become a technology giant. The incumbents have already gained significant power to command the lion share and the newcomers, if not acquired, will likely eventually fail.

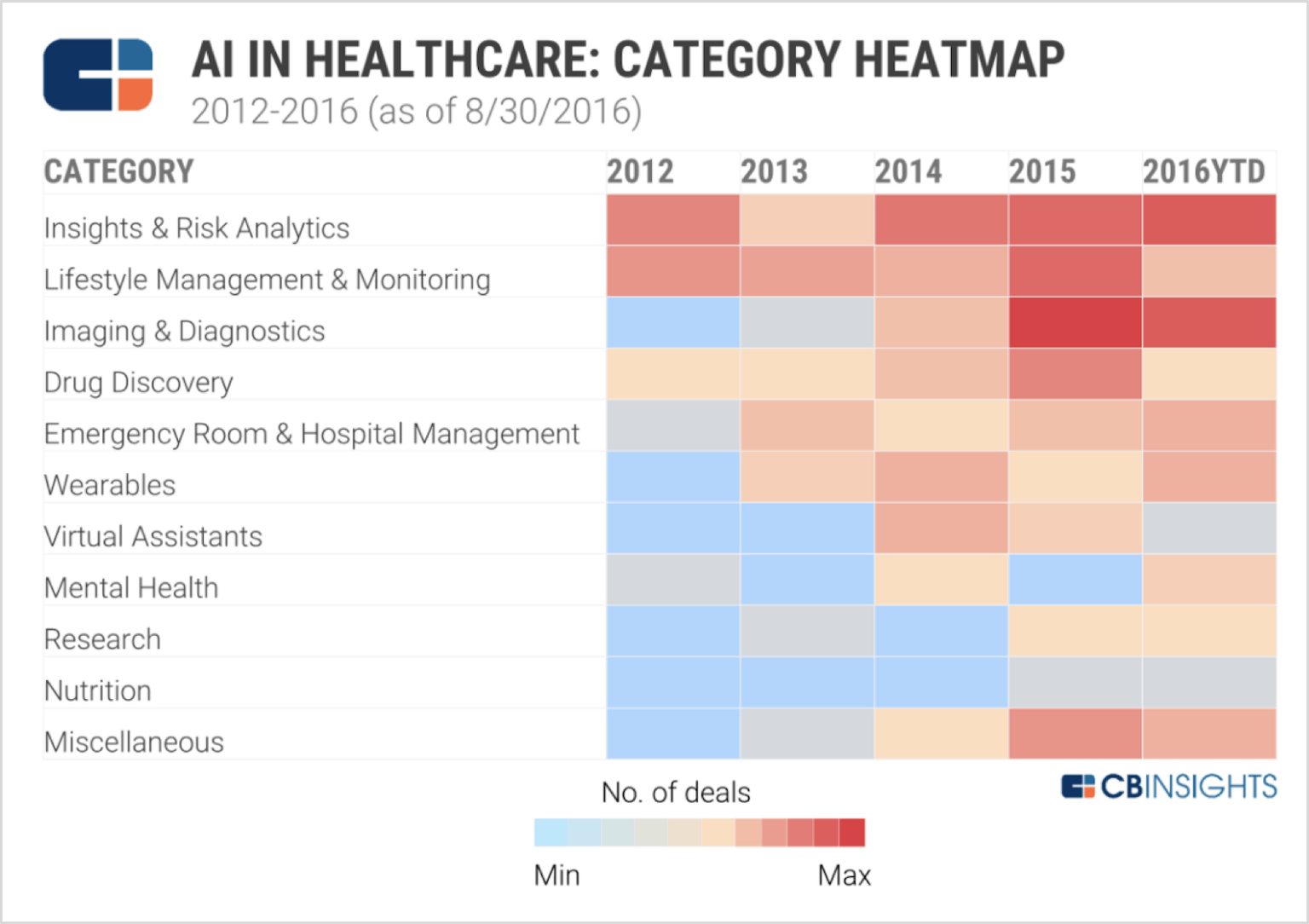

To exemplify how a technological advancement changes a sector, let’s take a look at healthcare. Healthcare is one of the digital laggers cited in the earlier mentioned McKinsey study. Technological developments in computer vision and image processing have a revolutionary impact on the healthcare field of Imaging and Diagnostics (CB Insights). The early signs of the maturing of the computer vision technology date to 2009 when ImageNet gathered 15m images in a database made available for computer vision research for free. In 2012 Google Brain spotted a cat without any help from labelled data. In 2014 Google acquired Deep Mind, a machine learning start-up with impressive results in the field. In 2016 Google DeepMind paired with NHS to use machine learning to fight blindness. Artificial Intelligence is likely to bring computer assisted glaucoma diagnosis to reality and prevent 98% of most severe visual loss cases (Ophthalmology Times).

Source: CB Insights “AI in Healthcare”, Sep 2016 (link)

Spotting advancements in computer vision technology in 2009–10 and linking these advancements to applications in Imaging & Diagnostics would have directionally helped an investor to bet on a soon-to-be-disrupted field.

Business Model: The optimal delivery agent

This one is relatively straightforward. Once technology and sector focus is narrowed, the task is to identify which models are likely to best serve the business.

Business models evolved over the last two decades from straight forward e-commerce structures to marketplaces aimed to achieving network effects and finally to SaaS (a current darling of the start-up world, even though it dominated telecom for decades). They evolved, much like sectors, due to the advancements in technology. SaaS, at the current scale of adoption, would have not been possible without the advancements in the elegance of programming languages, the infrastructure (high performance computing, the compute stack itself, storage), and the speed of connectivity. It seems that SaaS, in all its variations, dominates the current venture environment. For now.

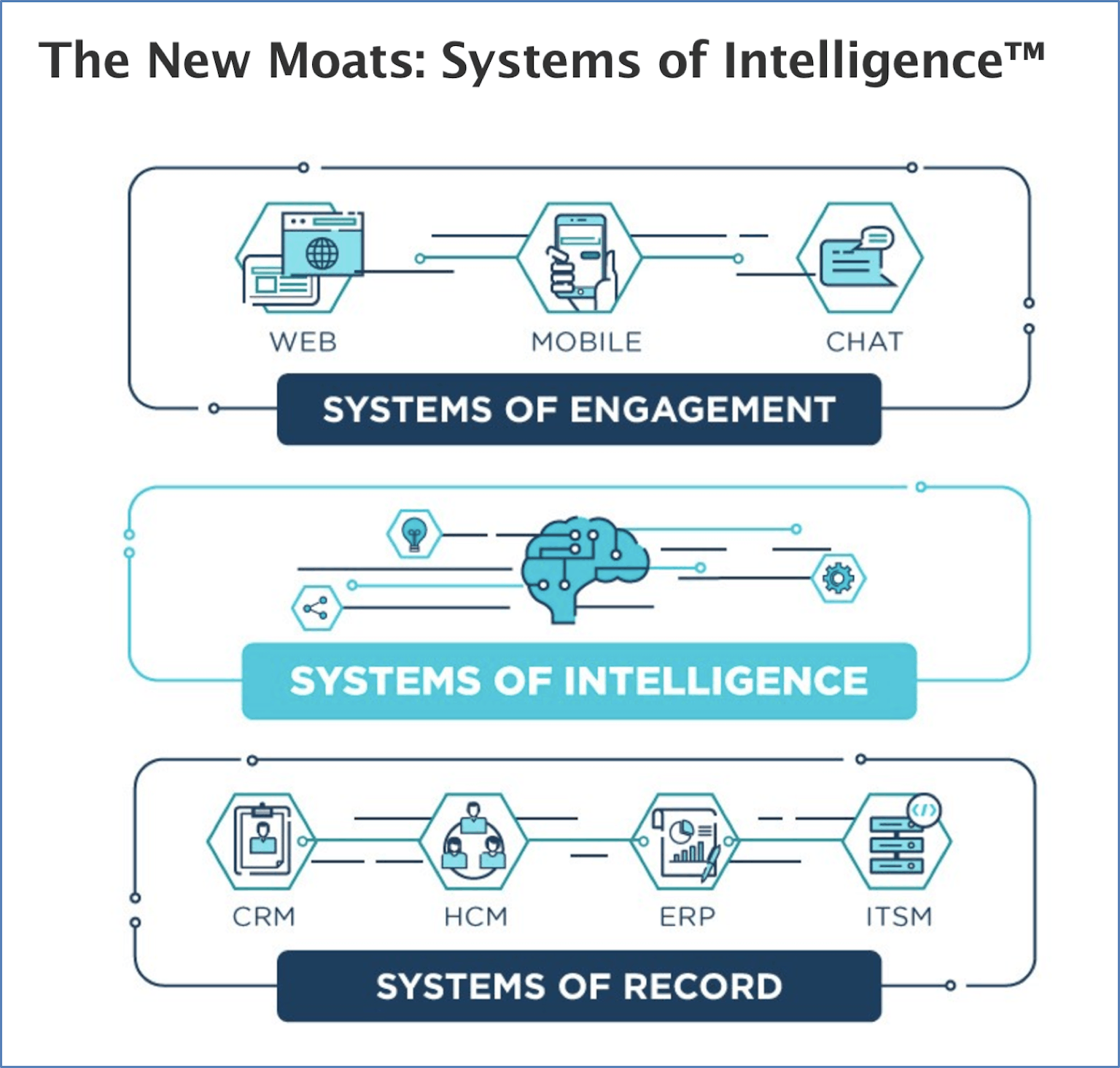

Jerry Chen of Greylock Partners introduces in “The New Moats” the concept of “Systems of Intelligence” as the next defensible business model. Chen argues that powerful technology, such as machine learning (ML), will combine with data, a business process, and an enterprise workflow to create the context to build a system of intelligence. As an example, Chen sites Google as an early pioneer of applying ML to a process and workflow: Google collected more data on every user and applied machine learning to serve up more timely ads within the workflow of a web search.

Source: “The New Moats”, Jerry Chen of Greylock Partners

Gil Dibner takes the concept of Systems of Intelligence further and presents it as an emerging VC meta-thesis. The era of network effects as meaningful barriers to entry is ending. Technology might be undergoing value inversion. Gil’s final statement asserts that “In assessing the value of a “Systems of Intelligence” company, we’ve got to focus on the barriers to entry created by the specific system that company is creating. The value will not come from the “intelligence” alone. The value is in the system itself.”

Identifying business models that are optimal for erecting meaningful barriers to entry and to building an intelligent business can point an investor to a space ahead of the bell curve. In the myriad of options on how to structure a business, there is only one best option. Identifying the best option is a process that involves a deep understanding of technology, its sector applications, and the sector itself.

Closing thoughts

Software will continue to eat the world. In the vast array of opportunities in early stage technology investment, focus, timing, and a deep due diligence are paramount. Before an investor runs off with allocating capital to opportunities and dives into due diligence on specific targets, it is best to set the boundaries of “where to play.” I believe that technology will continue to serve as a pathfinder and will lead companies, and investors, to superior economic returns when applied to ripe-for-adoption sectors in an optimal way. Cherchez la Tech, and you might find clarity in the choice of sector and business model focus.

I would love to hear your thoughts,

Cornel

Special thanks to Prof. Waverly Deutsch, Fernand Lendoye, Victoria Rusnac, and Vlad Cara for their valuable feedback in writing this post.

The above post is not intended as investment advice. All views, where not sourced, are subjective. The post expresses a view on asset allocation on a sector level and does not cover any topics related to the due diligence of a target. Please conduct a thorough due diligence before investing and seek professional investing, legal, and accounting advice where applicable.